Annual Report Bank Frick 2021: Annual profit more than doubled

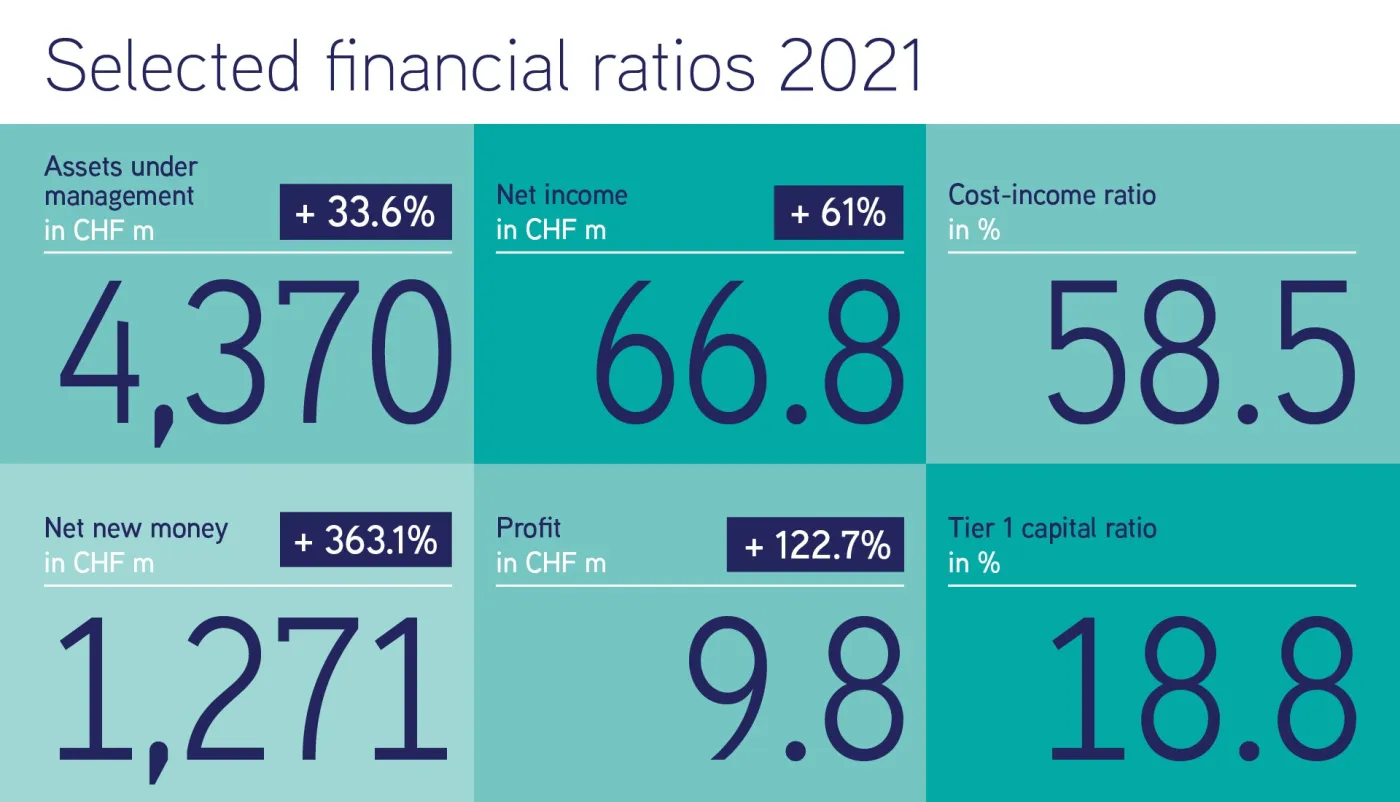

Bank Frick closes 2021 with an excellent annual profit of CHF 9.8 million. Net income increased again and client assets under management also grew in the reporting period. All the business segments contributed to the strong annual result. In order to further improve service to clients and be prepared for the future, resources were created and the front departments reorganised.

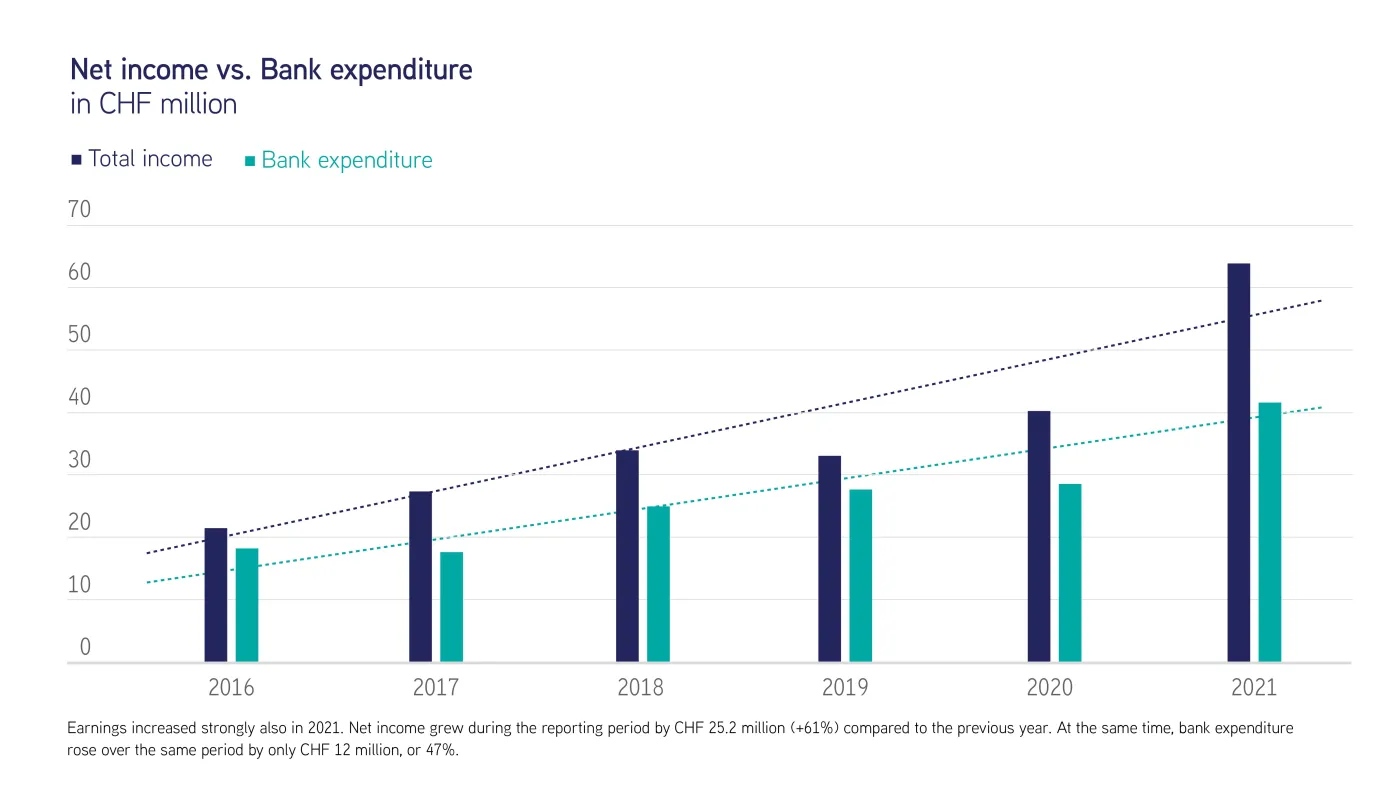

Bank Frick’s growth strategy has proven to be a success. 2021 closed with a very gratifying net profit of CHF 9.8 million. “The past year was extremely successful from an earnings perspective. We increased net income by 61% compared to the previous year and reported a profit of CHF 66.8 million,” says Bank Frick Chairman of the Board of Directors Mario Frick. At CHF 12.0 million (+ 47%), the growth in costs was significantly lower than revenue growth. “All our business segments contributed to this excellent annual result. At the same time, it is apparent that the traditional financial world is looking more and more closely at blockchain-based assets,” Frick said.

Income results in detail

Net income and income from commission and service transactions increased to CHF 34.8 million (2020: CHF 21.6 million).

Trading activities grew by CHF 4.9 million to CHF 11.3 million (2020: 6.4 million).

Net interest income increased to CHF 17.7 million and is thus around CHF 2.0 million higher than the figure for the previous period (CHF 14.8 million).

Client assets under management amounted to CHF 4.4 billion as of 31 December 2021 – an increase of 33% compared to the previous period (2020: CHF 3.3 billion). “We were thus able to impressively confirm the trend of increasing client assets in the financial year that has just started,” Frick notes.

More client service resources

“In June 2021, we reorganised our organisational units with direct client contact. To optimise our service to clients, we have made these departments more efficient. In this way, we put even more focus on the client experience,” says Bank-Frick CEO Edi Wögerer. The most obvious innovation is the establishment of the new Client Services department. The main purpose of this newly created department is to further improve the support of existing clients and the onboarding of new clients, thus making banking as easy as possible for our clients. “In recent years, we have made significant investments in technology, regulatory issues, compliance and the establishment of new business models. This new structure enables us to place our know-how in exactly the right areas,” Wögerer continues.

Outlook for the current financial year

In 2022, Bank Frick will continue to systematically pursue its growth strategy. “In doing so, our focus will be on recruiting additional staff across our departments and optimising our processes and use of resources,” says Wögerer. Thanks to the very good order situation and the consistently very high workload of its employees, Bank Frick plans to continue to expand staff numbers.

There are many uncertainties around how the global economy and therefore also Bank Frick’s business performance will develop. Above all, the war in Ukraine makes it difficult to look into the future. In addition, there is still great uncertainty regarding the further development of the COVID-19 pandemic and also the expected inflation.

“Despite the prevailing uncertainties, we are confident that the investments made in 2021 in restructuring and optimising our strategic business segments will pay off and that we will succeed in acquiring further new and high-value clients. This will have a positive impact on the 2022 financial statements,” explains Wögerer. “However, we also do not expect certain extraordinary items to have the same impact on income as in the reporting period. Based on this starting position, we expect a net profit of CHF 8.0 million in the current financial year,” says Wögerer.

About Bank Frick

Bank Frick specialises in banking for professional clients. The Liechtenstein bank provides a fully integrated offering of classic banking and blockchain banking services. Its clients include fintechs, asset managers, payment service providers, family offices, fund promoters, pension funds and fiduciaries.

Bank Frick has been family-run since its foundation as a licensed universal bank in 1998, and it adopts an entrepreneurial approach. Today the Bank is entirely owned by the Kuno Frick Family Foundation (KFS). The Bank employs over 140 members of staff at its Balzers office and operates a branch in London, UK.

Bank Frick is one of Europe’s pioneers of the regulated blockchain banking sector. The offering covers trading and custody of crypto assets and token sales. The Bank also develops tailored crypto-structuring solutions for intermediaries.

In addition to its highly regarded basic services, Bank Frick’s classic banking offerings cover services for funds and issues, focusing on formulating European (AIF, UCITS) and national fund solutions. In the capital market sector, Bank Frick develops tailored financial products for intermediaries and supports them along the whole issue process, acting also as a custodian bank.

Bank Frick is the only Liechtenstein bank with acquiring licences from Visa and MasterCard, and it can process card payments globally for payment service providers and their online merchants.

Share post

Related Articles

Press release 2023 semi-annual report

Bank Frick generated a net profit of CHF 7.2 million in the first half of 2023 and thus built on the success of the prior financial year. The marked increase in profit, coupled with solid utilisation and good capitalisation, provides us with encouragement for the second half of the year. We therefore anticipate an annual profit in the region of CHF 13 million for 2023.

Bank Frick is now offering staking as a service for digital assets

Bank Frick is launching staking as a new service. Staking enables clients to generate passive income by holding their cryptocurrency. Staking also contributes to the stability of networks. As a fully regulated bank, Bank Frick guarantees continuity of business at all times and full control of funds. Initially, the cryptocurrencies Tezos (XTZ) and Polkadot (DOT) will be offered.

Half-year result: Continuous growth by Bank Frick – despite uncertainties about the global economy

In the first half of 2022, Bank Frick generated a net profit of CHF 5.1 million, with all strategic business segments contributing to this positive result. Despite the currently prevailing uncertainty stemming from the unstable economic situation, Bank Frick succeeded in increasing its profit compared with the first half of 2021. For 2022, the Bank therefore expects an annual profit in the order of CHF 8 million.

Bank Frick expands its range of crypto assets and now offers trading and custodian services for Cardano, Polkadot and Tezos

Europe’s blockchain pioneer has expanded the range of cryptocurrencies for which it offers trading and custodian services. Bank Frick now offers financial intermediaries and professional clients the option of trading in and secure custody of Cardano (ADA), Polkadot (DOT) and Tezos (XTZ) coins. Trading takes place within the fully regulated environment of the Bank.

Marianne Müller new on the Board of Directors

The Board of Directors (BoD) of Bank Frick has appointed Marianne Müller as a new member of the Board of Directors effective 1 May 2022. She brings with her great expertise in the areas of regulatory affairs, compliance and financial market supervision.

Half-year results of Bank Frick: Budgeted annual result of CHF 3.1 million already achieved

Bank Frick generated a net profit of CHF 3.1 million in the first half-year. All strategic business segments contributed to this long-term result. For 2021, the Bank therefore expects an annual profit in the order of CHF 5 million. Thanks to the successful reorganisation initiative of the departments involving direct client contact, we have been able to pay even closer attention to the client experience.

Bank Frick processes donations in the form of cryptocurrencies

Bank Frick now processes donations in the form of cryptocurrencies for the Swiss section of the human rights organisation Amnesty International (Amnesty Switzerland). Bank Frick has developed a set-up that enables the reliable, regulatory compliant and secure acceptance of crypto donations. This model is suitable for all NGOs to carefully check the origin of crypto donations.

Strategy takes hold, with a steady increase in net income

Despite challenging circumstances, Bank Frick generated a net profit of some CHF 4.4 million. The years-long trend of continuously increasing income was confirmed in all business areas, and the growth in expenses has flattened out. Thanks to the successful strategic orientation of the entrepreneurial Bank, net income has doubled to some CHF 40.0 million in just five years.

Semi-annual results: Bank Frick defies the coronavirus pandemic

The first half of 2020 at Bank Frick was dominated by the global coronavirus pandemic. Despite the prevailing uncertainty and high volatility on the financial markets and the unstable economic situation, the Bank generated a net profit of CHF 1.8 million. Because of the pandemic, Bank Frick cannot rule out the occurrence of credit defaults. In keeping with the principle of prudence, the Bank will create provisions accordingly. As such, Bank Frick anticipates a net income in the range of CHF 1.0 to CHF 2.0 million.

Bank Frick adds first stablecoin to its range of tradable and custodial crypto assets with USDC

Europe's leading blockchain bank is adding a stablecoin to its range of tradable and custodial crypto currencies for the first time. With immediate effect, Bank Frick offers professional market participants and wealthy private clients the trading and safekeeping of the USD Coin (USDC). Trading takes place within the fully regulated environment of the bank.