Bank Frick annual report 2023: annual profit remains strong at CHF 13.5 million.

Bank Frick closed 2023 with a record profit of CHF 13.5 million, underscoring the sustained growth path. This was 6.9% ahead of expectations.

“All four business segments contributed to the strong annual results. Interest in blockchain technology and assets is also growing steadily in the traditional financial sector. Our new payment service Bank Frick xPULSE and our staking services mark a diversification of our portfolio. We are offering our clients a broader range of financial services that are at once secure and user-friendly and provide pioneering investment opportunities. What’s more, our growth strategy has been fully vindicated,” said Bank Frick CEO Edi Wögerer.

Overall, the features that dominated the financial markets in 2023 were geopolitical discord and turbulent price fluctuations. “We are delighted that we were ahead of budget in all our business segments, especially given the challenging market environment,” he went on.

Income summary

Net income from commission and service transactions fell to CHF 24.5 million (2022: CHF 32.4 million), which was about 18% lower than budgeted.

Income from trading activities performed very well and almost doubled from the previous year, rising CHF 14.8 million to CHF 30.6 million.

Net interest income totalled CHF 47.0 million, an increase of around CHF 20 million (+74%) from the previous period (CHF 27.0 million). The protracted environment of high interest rates coupled with multiple interest rate hikes contributed to this anomalously good result.

Client assets under management amounted to CHF 4.1 billion at 31 December 2023 – an increase of 2.39% compared to the previous period (2022: CHF 4.0 billion).

25 years of Bank Frick

We celebrated our 25th anniversary in the reporting year. Our entrepreneurial DNA has remained unchanged, and our willingness to implement new approaches and bold innovations is still palpable. “To celebrate the anniversary we threw a party for our employees and guests. It was a moment to say thank you from the bottom of our heart and to share our pride at what we have achieved together. We look back with great humility and thank all of those involved for their contribution to our shared history of Bank Frick,” said Mario Frick, Chairman of the Board of Directors of Bank Frick.

Outlook for 2024

“It remains difficult to predict how the global economy will perform in 2024, and hence also how business will be for Bank Frick. We expect that our result for 2024 will come in at a level similar to that of the previous year. Our investments in personnel and infrastructure will remain at a high level. We are also keeping a close eye on the shrinking interest margins. We therefore anticipate a net profit of CHF 13.5 million,” said Bank Frick CEO Edi Wögerer.

“In 2024 we will again be focusing on our strong points, driving our growth strategy ahead vigorously and, along with our employees, realising our objectives. We are confident that together we can achieve our ambitious goals,” he concluded.

The annual report of Bank Frick is available here.

About Bank Frick

Bank Frick specialises in banking for professional clients. The Liechtenstein bank provides a fully integrated offering of classic banking and blockchain banking services. Its clients include fintechs, asset managers, payment service providers, family offices, fund promoters, pension funds and fiduciaries.

Bank Frick has been family-run since its foundation as a licensed universal bank in 1998, and it adopts an entrepreneurial approach. Today the Bank is entirely owned by the Kuno Frick Family Foundation (KFS). The Bank employs over 250 members of staff at its Balzers office and operates a branch in London, UK.

Bank Frick is one of Europe’s pioneers of the regulated blockchain banking sector. The offering covers trading and custody of crypto assets and token sales. The Bank also develops tailored crypto-structuring solutions for intermediaries.

In addition to its highly regarded basic services, Bank Frick’s classic banking offerings cover services for funds and issues, focusing on formulating European (AIF, UCITS) and national fund solutions. In the capital market sector, Bank Frick develops tailored financial products for intermediaries and supports them along the whole issue process, acting also as a custodian bank.

Bank Frick is the only Liechtenstein bank with acquiring licences from Visa and MasterCard, and it can process card payments globally for payment service providers and their online merchants.

Share post

Related Articles

Bank Frick plans new branch in Dubai

Bank Frick is expanding its international presence with plans to establish a branch in the finance and growth market of Dubai. This step will enable the Bank to pursue its strategy and strengthen its position as a product leader and blockchain pioneer.

Bank Frick receives ISO 27001 certification for the highest level of security

Bank Frick has received the internationally recognised ISO 27001 certification, which is a strong sign of its commitment to information security. The award confirms the Bank’s high standards when it comes to protecting sensitive data and strengthens its position as an innovative and trustworthy partner in the finance industry.

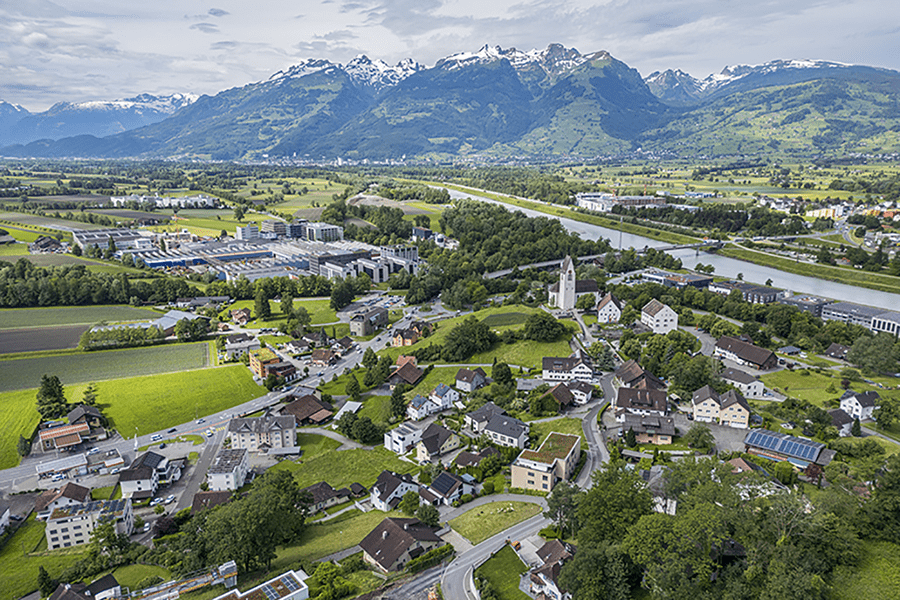

Bank Frick plans its new head office in Bendern

Bank Frick has received approval from the municipality of Gamprin for a building lease plot in Unterbendern. Once completed, its new head office will have room for up to 700 employees. The new building will meet the Bank’s growing need for space, bring its employees back together at one location and use a multifunctional, future-oriented solution.

Interview with CEO Edi Wögerer in «USA Today»

What sets Bank Frick apart from other banks? What role do blockchain business models play? And what vision is the bank pursuing? CEO Edi Wögerer spoke about these questions in an interview with the business magazine «Business Focus», which appears in the US daily newspaper «USA Today».

Bank Frick and Stablecoin Standard to forge strategic partnership for secure and transparent stablecoin solutions

Bank Frick and Stablecoin Standard will work together strategically to advance the development of secure and transparent stablecoin solutions. The target of the partnership is to promote innovation and create stable, regulatory-compliant models.

Opening and trading hours over the holidays and 2025

Bank Frick will be closed for the holidays from Tuesday, 24 December 2024 to Thursday, 26 December 2024. The following week, Bank Frick will be closed from Tuesday, 31 December 2024 to Thursday, 2 January 2025. Payment orders that are still to be considered for 2024 must be submitted to the Bank by Friday, 27 December 12.00.

How Blockchain Enables Transparency and Efficiency

Blockchain technology, first demonstrated in 2010 through a historic Bitcoin transaction, has evolved far beyond cryptocurrencies, offering solutions for transparency, efficiency, and decentralization across industries. Its core principles—decentralization, transparency, and immutability—enable secure, peer-to-peer transactions without intermediaries. Innovations like Ethereum's smart contracts have expanded blockchain's capabilities, impacting supply chains, automation, and governance.

Despite concerns about energy use, modern blockchains are increasingly energy-efficient, and misconceptions about complexity or security often stem from misunderstandings. For nonprofits, blockchain offers transformative potential: donations can be transferred quickly, cost-effectively, and transparently, ensuring more funds reach beneficiaries while improving accountability and impact measurement.

As blockchain reshapes societal structures and trust, it presents nonprofits with powerful tools to amplify their impact. Organizations willing to embrace this innovation will be well-positioned to drive meaningful change in an interconnected digital world.

Between vault and IT lab - Zukunftstag at Bank Frick

“Come in!” With these words, Bank Frick apprentices Nico and Luca, together with the HR manager Andrea, welcomed 15 children to the National Zukunftstag today. In the main building in Balzers, the children discovered the fascinating world of crypto and blockchain - a subject area in which Bank Frick is one of the pioneers throughout Europe. In addition to a crash course on these topics, the young guests were given insights into other business areas such as classic banking, fund and capital markets and e-commerce.

Apply now: Bank Frick awards scholarship for blockchain and fintech programmes at the University of Liechtenstein

Vaduz – As part of its partnership with the University of Liechtenstein, Bank Frick is awarding a scholarship to cover participation in the blockchain and fintech certificate programme or the blockchain and fintech CAS. The deadline for applications is 13 December 2024, and the course will begin on 9 January 2025.

Bank Frick authorised by SIX as a new crypto asset custodian

Bank Frick has been approved by SIX as a custodian for crypto assets and can thus continue to act as a custodian for crypto ETPs.