Annual Report Bank Frick 2022: Annual profit breaks through the 10 million mark for the first time

Bank Frick closes 2022 with a record profit of CHF 10.3 million, breaking through the 10 million mark for the first time and increasing its annual profit by 4.5% compared to the previous year. Its growth strategy, combined with high investment in staff and infrastructure, has proven to be successful.

“All four business segments contributed to these excellent annual results. Interest in blockchain-based assets has also continued to grow in the traditional financial world. The topics of cryptocurrencies and blockchain have been increasing in the awareness among the general public. Moreover, our company's growth strategy, based on these four strategic business units, has been a resounding success”, says Mario Frick, Chairman of the Board of Directors of Bank Frick.

In general, 2022 was marked by geopolitical crises and a paradigm shift in monetary policy. Furthermore, 2022 was one of the worst years for the stock market in a long time. “We are therefore all the more pleased that we achieved this result, despite the very challenging market environment, and that we were able to exceed our budget targets across the board”, Frick continues.

Income summary

Net income and income from commission and service transactions decreased minimally to CHF 32.4 million (2021: CHF 34.8 million), but is around 16% above budget.

Income from trading activities grew by CHF 4.5 million compared to the previous year, totalling CHF 15.7 million.

Net interest income totalled CHF 27.0 million, an increase of around CHF 9.4 million from the previous period (CHF 17.7 million). The drastic change from a negative interest rate environment to a high interest rate environment created additional opportunities for earning interest from other areas.

Client assets under management as of 31 December 2022, are CHF 4.0 billion, a decrease of CHF 0.4 billion or 8.4% compared to the previous period (2021: CHF 4.4 billion).

25 years of Bank Frick

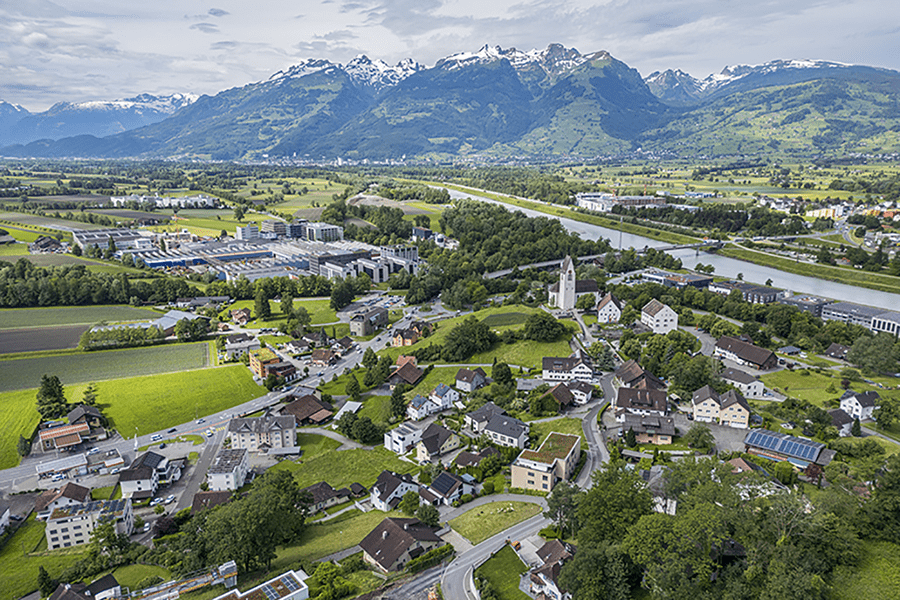

Bank Frick celebrates its 25th anniversary in 2023. What began in the garage of an apartment building in 1998 has become an important player in the financial centre over the past 25 years. More than 200 employees put their efforts into serving our clients every day. We will celebrate the anniversary together with our employees in the second half of the year – as a mark of gratitude for the past 25 years and as a beginning to a future full of potential.

Outlook for 2023

“Global economic development is subject to many uncertainties. And so is Bank Frick's business performance. Nevertheless, we expect significantly better results in terms of interest income thanks to the reversal in interest rates. Together with the budgeted net new money, we forecast a net profit of CHF 12.6 million in this financial year”, says CEO of Bank Frick, Edi Wögerer.

“In 2023, we will continue to focus on our strengths, pursue our growth strategy with resolve and thus accomplish our plans and projects together with our employees. We are convinced that we will achieve our ambitious goals together as a team”, concludes Wögerer.

The Bank Frick annual report is available here.

About Bank Frick

Bank Frick specialises in banking for professional clients. The Liechtenstein bank provides a fully integrated offering of classic banking and blockchain banking services. Its clients include fintechs, asset managers, payment service providers, family offices, fund promoters, pension funds and fiduciaries.

Bank Frick has been family-run since its foundation as a licensed universal bank in 1998, and it adopts an entrepreneurial approach. Today the Bank is entirely owned by the Kuno Frick Family Foundation (KFS). The Bank employs over 200 members of staff at its Balzers office and operates a branch in London, UK.

Bank Frick is one of Europe’s pioneers of the regulated blockchain banking sector. The offering covers trading and custody of crypto assets and token sales. The Bank also develops tailored crypto-structuring solutions for intermediaries.

In addition to its highly regarded basic services, Bank Frick’s classic banking offerings cover services for funds and issues, focusing on formulating European (AIF, UCITS) and national fund solutions. In the capital market sector, Bank Frick develops tailored financial products for intermediaries and supports them along the whole issue process, acting also as a custodian bank.

Bank Frick is the only Liechtenstein bank with acquiring licences from Visa and MasterCard, and it can process card payments globally for payment service providers and their online merchants.

Share post

Related Articles

Bank Frick plans new branch in Dubai

Bank Frick is expanding its international presence with plans to establish a branch in the finance and growth market of Dubai. This step will enable the Bank to pursue its strategy and strengthen its position as a product leader and blockchain pioneer.

Bank Frick receives ISO 27001 certification for the highest level of security

Bank Frick has received the internationally recognised ISO 27001 certification, which is a strong sign of its commitment to information security. The award confirms the Bank’s high standards when it comes to protecting sensitive data and strengthens its position as an innovative and trustworthy partner in the finance industry.

Bank Frick plans its new head office in Bendern

Bank Frick has received approval from the municipality of Gamprin for a building lease plot in Unterbendern. Once completed, its new head office will have room for up to 700 employees. The new building will meet the Bank’s growing need for space, bring its employees back together at one location and use a multifunctional, future-oriented solution.

Interview with CEO Edi Wögerer in «USA Today»

What sets Bank Frick apart from other banks? What role do blockchain business models play? And what vision is the bank pursuing? CEO Edi Wögerer spoke about these questions in an interview with the business magazine «Business Focus», which appears in the US daily newspaper «USA Today».

Bank Frick and Stablecoin Standard to forge strategic partnership for secure and transparent stablecoin solutions

Bank Frick and Stablecoin Standard will work together strategically to advance the development of secure and transparent stablecoin solutions. The target of the partnership is to promote innovation and create stable, regulatory-compliant models.

Opening and trading hours over the holidays and 2025

Bank Frick will be closed for the holidays from Tuesday, 24 December 2024 to Thursday, 26 December 2024. The following week, Bank Frick will be closed from Tuesday, 31 December 2024 to Thursday, 2 January 2025. Payment orders that are still to be considered for 2024 must be submitted to the Bank by Friday, 27 December 12.00.

How Blockchain Enables Transparency and Efficiency

Blockchain technology, first demonstrated in 2010 through a historic Bitcoin transaction, has evolved far beyond cryptocurrencies, offering solutions for transparency, efficiency, and decentralization across industries. Its core principles—decentralization, transparency, and immutability—enable secure, peer-to-peer transactions without intermediaries. Innovations like Ethereum's smart contracts have expanded blockchain's capabilities, impacting supply chains, automation, and governance.

Despite concerns about energy use, modern blockchains are increasingly energy-efficient, and misconceptions about complexity or security often stem from misunderstandings. For nonprofits, blockchain offers transformative potential: donations can be transferred quickly, cost-effectively, and transparently, ensuring more funds reach beneficiaries while improving accountability and impact measurement.

As blockchain reshapes societal structures and trust, it presents nonprofits with powerful tools to amplify their impact. Organizations willing to embrace this innovation will be well-positioned to drive meaningful change in an interconnected digital world.

Between vault and IT lab - Zukunftstag at Bank Frick

“Come in!” With these words, Bank Frick apprentices Nico and Luca, together with the HR manager Andrea, welcomed 15 children to the National Zukunftstag today. In the main building in Balzers, the children discovered the fascinating world of crypto and blockchain - a subject area in which Bank Frick is one of the pioneers throughout Europe. In addition to a crash course on these topics, the young guests were given insights into other business areas such as classic banking, fund and capital markets and e-commerce.

Apply now: Bank Frick awards scholarship for blockchain and fintech programmes at the University of Liechtenstein

Vaduz – As part of its partnership with the University of Liechtenstein, Bank Frick is awarding a scholarship to cover participation in the blockchain and fintech certificate programme or the blockchain and fintech CAS. The deadline for applications is 13 December 2024, and the course will begin on 9 January 2025.

Bank Frick authorised by SIX as a new crypto asset custodian

Bank Frick has been approved by SIX as a custodian for crypto assets and can thus continue to act as a custodian for crypto ETPs.