Solend – Governance debacle or necessary evil?

This week, our blockchain experts assessed the following topics:

- Solend – Governance debacle or necessary evil?

- 3AC –Prime Crypto hedge fund in trouble

- CBDC as a tool for monetary independence

- Crypto crash: Are crypto exchanges coming out on top?

Our bi-weekly Crypto Industry Report provides you with valuable information on the global crypto industry – picked and analysed by our blockchain experts.

Solend – Governance debacle or necessary evil?

The world of decentralised finance (DeFi) is having a rough time. Token values have dropped significantly, and one of its popular projects – Terra’s algorithmic stablecoin UST – completely imploded a few weeks back. Yet another incident that shed some bad light on DeFi recently happened in the Solana ecosystem. Through a governance vote on the Solana-based lending and borrowing protocol Solend, users voted to grant “special” parties the rights to liquidate a borrower’s assets. Although the vote was conducted on-chain, there was a quirky element to it. It was launched without announcement and one wallet paid $700,000 for additional voting power, ultimately making up 90% of votes.

The assets voted on belonged to a Solana whale, whose deposits – at times – made up 95% of Solend’s entire SOL pool and represented 88% of the total USDC borrowing on the protocol. With cryptocurrency prices falling through the roof, the whale’s position came dangerously close to liquidation. Such an on-chain liquidation could have severely hampered Solend’s DEX liquidity, leading to devastating effects for SOL and Solend with potentially more turmoil for the wider DeFi market.

While the vote was later reversed through another vote following shortly after, and the event did not highlight any inherent flaw of a PoS system as was falsely claimed initially, the incident nevertheless sparked a debate. Some people inferred that such an action would be altogether illegal if performed in the traditional financial system. Other commentators called Solend’s decentralisation into question, with some hinting at the even bigger question of whether the DeFi world at large can currently stand up to the promises of decentralisation.

Proponents of different DeFi protocols were quick to point out that such an incident would never happen on their protocol. However, the question with DeFi ought not to be whether or not this would ever happen but if it even could happen. Or in other words: DeFi is really only decentralised if decentralisation cannot be tampered with. This is the crux of the matter and might be a tough nut to crack. After all, governance can be a feature as well as a bug – depending on the context. The question DeFi will have to answer in the future, is: How much governance is too much governance?

3AC –Prime Crypto hedge fund in trouble

A few weeks ago, when Celsius halted its withdrawals signalling liquidity problems, rumours that more crypto companies would be under the weather started circulating. While most of rumours turned out to be true, the most surprising revelation was the fact that one of crypto’s most prominent crypto hedge funds by the name of Three Arrows Capital (3AC) has run into trouble as well.

The hedge fund was founded in 2012 and has become one of the biggest venture capitalists for new crypto projects. Among its investments are notable projects such as Solana, Avalanche, Near, Aave, Polkadot, Axie Infinity, and many more. Like many market participants, 3AC had pledged large amounts of its crypto portfolio as collateral to raise additional money through borrowing. However, the falling crypto markets led to their collateral losing value to the point that with many outstanding loans, the collateral was no longer sufficient to cover the loans.

Among the most severely affected creditors is digital asset brokerage Voyager. The company lent about $670 million to 3AC in an unsecured loan, only to find the Singapore-based crypto hedge fund default on it a few days ago. While Voyager announced that the broker intends to pursue recovery from 3AC, the failure on their part to seemingly apply no prudent risk management at all is astonishing.

Whether there is much money to get out of 3AC is currently unclear. As a matter of fact, reports made the rounds that in order to meet loan requirements, 3AC even seized capital from third-party trading accounts running through their platform with neither consultation nor consent. Some have even accused 3AC of having run a Ponzi scheme. While the final jury is still out, the incident once more shows that Bitcoin’s mantra of “don’t trust, verify” is highly relevant and that the current painful market crash will hopefully expose as much of the ill-intentioned actors as possible.

CBDC as a tool for monetary independence

In the developed part of the world, CBDC development is still sluggish. If anything, central banks of countries in Europe, Asia or the United States are looking at a wholesale implementation for a CBDC. Conversely, the retail angle of a central bank digital currency seems to be the prime focus of CBDCs endeavours in other parts of the world.

In the country of Iran, officials have announced that they are preparing to roll out a pilot version of a retail CBDC by September of this year. This new digital currency will be named Crypto-Rial and shall be designed to act as a substitute for the banknotes currently used by the Iranian people. Judging by the fact that Iran has been facing sanctions from the United States and other jurisdictions, the goal of launching an independent CBDC seems like an obvious step from their point of view.

The same goes for Russia. Even though its central bank is only just now developing a roadmap, things are accelerating and a CBDC shall be introduced by the end of 2023. With the goal of working out cross-border integrations between this digital ruble and other countries’ CBDCs, the Russian central bank wants to kick off its CBDC as soon as possible. With this step, the country hopes to gain more independence from SWIFT, the messaging system predominantly currently used by banks all around the world.

On the continent of Africa, two more countries have moved into their CBDC pilot phase, following Nigeria’s October 2021 introduction of e-Naira. As one of the few African countries, South Africa is currently piloting a wholesale CBDC project. This endeavour is part of a bigger cross-border pilot with the central banks of Australia, Malaysia and Singapore. Meanwhile the central bank of Ghana is opting for a retail CBDC called e-Cedi. Its goal is to make the general payment system more cost-efficient. As it stands, with an average cost of just under 8%, these transactions are still among the most expensive in the world. And while many other African nations’ CBDC projects are still in research mode, due to a greater need, we might see these projects take off sooner than in the Western parts of the world.

Crypto crash: Are crypto exchanges coming out on top?

Crypto prices have been shattered across the board and there is no central bank stepping in as a stabiliser unlike in the traditional world of finance. Well, there might not be an official lender of last resort, but industry titans are seizing their chance. In the spirit of private bail-outs, the Bahama-based cryptocurrency exchange FTX provided lifelines to companies like BlockFi or Voyager. The cumulative value of these loans was an astonishing $750 million. In the case of BlockFi, there were even talks that the highly profitable cryptocurrency exchange would acquire a stake in the crypto lending company.

While FTX’s CEO, Sam Bankman-Fried (SBF), considers these acts as his duty and responsibility to avoid further contagion, others are quick to point out that this type of self-interest is reminiscent of the time of Robber Barons during the 19th century. In a latest rumour, FTX was said to be interested in buying stock trading application and Fintech darling Robinhood. So far, such plans were denied by SBF.

Notwithstanding FTX's true intentions, there is a case to be made that some of the bigger crypto exchanges will be the ones emerging as the winners from the recent crypto crash. This is also echoed by recent announcements from Binance.

The world’s biggest cryptocurrency exchange might not have embarked on a similar buying spree as FTX but Binance has similarly indicated that the company shows no signs of financial stress. In the last quarter, the exchange burnt $741 million as part of their BNB burn program. Furthermore, a partnership with Cristiano Ronaldo, one of the world’s most famous superstars, was announced. In collaboration with the soccer player, Binance will launch several NFT collections that can be purchased exclusively on its NFT marketplace.

Last but not least, the cryptocurrency exchange is seeking to establish a domicile in the canton of Zug, Switzerland. The main purpose of this new subsidiary called Binance Switzerland AG is to allow for the trading of digital assets. This move seems like an encouraging one and goes to show that Binance is actively and seriously looking to acquire the necessary trading licenses after the platform has faced regulatory issues in various country over the last few months.

Share post

Related Posts

Bank Frick plans new branch in Dubai

Bank Frick is expanding its international presence with plans to establish a branch in the finance and growth market of Dubai. This step will enable the Bank to pursue its strategy and strengthen its position as a product leader and blockchain pioneer.

Bank Frick receives ISO 27001 certification for the highest level of security

Bank Frick has received the internationally recognised ISO 27001 certification, which is a strong sign of its commitment to information security. The award confirms the Bank’s high standards when it comes to protecting sensitive data and strengthens its position as an innovative and trustworthy partner in the finance industry.

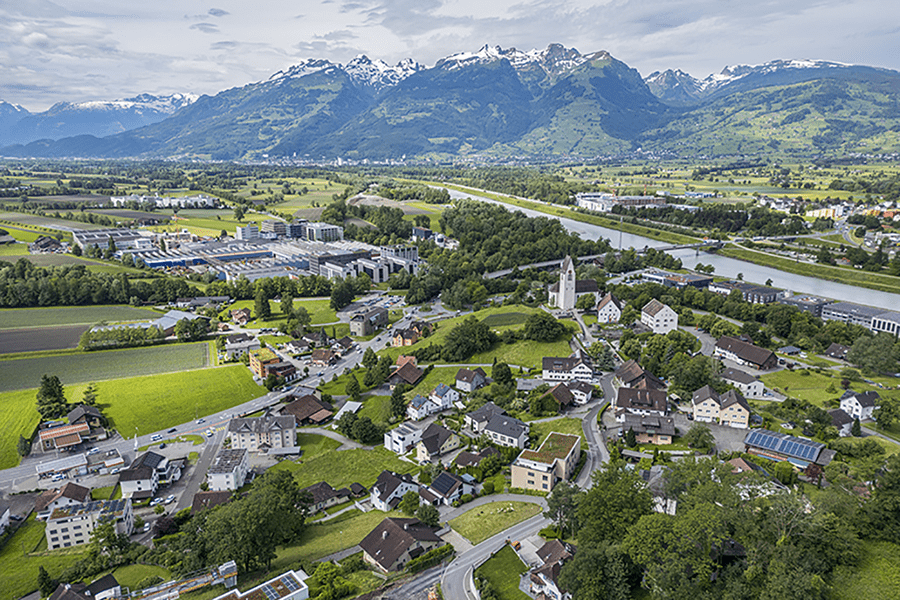

Bank Frick plans its new head office in Bendern

Bank Frick has received approval from the municipality of Gamprin for a building lease plot in Unterbendern. Once completed, its new head office will have room for up to 700 employees. The new building will meet the Bank’s growing need for space, bring its employees back together at one location and use a multifunctional, future-oriented solution.

Interview with CEO Edi Wögerer in «USA Today»

What sets Bank Frick apart from other banks? What role do blockchain business models play? And what vision is the bank pursuing? CEO Edi Wögerer spoke about these questions in an interview with the business magazine «Business Focus», which appears in the US daily newspaper «USA Today».

Bank Frick and Stablecoin Standard to forge strategic partnership for secure and transparent stablecoin solutions

Bank Frick and Stablecoin Standard will work together strategically to advance the development of secure and transparent stablecoin solutions. The target of the partnership is to promote innovation and create stable, regulatory-compliant models.

Opening and trading hours over the holidays and 2025

Bank Frick will be closed for the holidays from Tuesday, 24 December 2024 to Thursday, 26 December 2024. The following week, Bank Frick will be closed from Tuesday, 31 December 2024 to Thursday, 2 January 2025. Payment orders that are still to be considered for 2024 must be submitted to the Bank by Friday, 27 December 12.00.

How Blockchain Enables Transparency and Efficiency

Blockchain technology, first demonstrated in 2010 through a historic Bitcoin transaction, has evolved far beyond cryptocurrencies, offering solutions for transparency, efficiency, and decentralization across industries. Its core principles—decentralization, transparency, and immutability—enable secure, peer-to-peer transactions without intermediaries. Innovations like Ethereum's smart contracts have expanded blockchain's capabilities, impacting supply chains, automation, and governance.

Despite concerns about energy use, modern blockchains are increasingly energy-efficient, and misconceptions about complexity or security often stem from misunderstandings. For nonprofits, blockchain offers transformative potential: donations can be transferred quickly, cost-effectively, and transparently, ensuring more funds reach beneficiaries while improving accountability and impact measurement.

As blockchain reshapes societal structures and trust, it presents nonprofits with powerful tools to amplify their impact. Organizations willing to embrace this innovation will be well-positioned to drive meaningful change in an interconnected digital world.

Between vault and IT lab - Zukunftstag at Bank Frick

“Come in!” With these words, Bank Frick apprentices Nico and Luca, together with the HR manager Andrea, welcomed 15 children to the National Zukunftstag today. In the main building in Balzers, the children discovered the fascinating world of crypto and blockchain - a subject area in which Bank Frick is one of the pioneers throughout Europe. In addition to a crash course on these topics, the young guests were given insights into other business areas such as classic banking, fund and capital markets and e-commerce.

Apply now: Bank Frick awards scholarship for blockchain and fintech programmes at the University of Liechtenstein

Vaduz – As part of its partnership with the University of Liechtenstein, Bank Frick is awarding a scholarship to cover participation in the blockchain and fintech certificate programme or the blockchain and fintech CAS. The deadline for applications is 13 December 2024, and the course will begin on 9 January 2025.

Bank Frick authorised by SIX as a new crypto asset custodian

Bank Frick has been approved by SIX as a custodian for crypto assets and can thus continue to act as a custodian for crypto ETPs.