2024 semi-annual report

Bank Frick reported a substantial net profit of CHF 5.5 million in the first half of 2024 and is adhering to its growth strategy. Investments in staff and infrastructure remain high. Despite the persistently uncertain economic situation, Bank Frick expects an annual profit of CHF 12 million.

“We close the first half-year with a net profit of CHF 5.5 million, and we believe that we remain on a positive track. The decline of CHF 1.7 million compared to the 2023 half-year result is mainly due to the increased sensitivity of our clients to interest rates. We also made significant investments in staff and infrastructure in the reporting period,” says Edi Wögerer, CEO of Bank Frick.

The current economic environment is challenging. Nevertheless, Bank Frick is confident about its prospects for the second half of the year and sees potential for further sustainable growth. “Our focus is on responding flexibly to the changed market conditions and in doing so further strengthening our product leadership. In keeping with the spirit of Bank Frick, we are relying on innovative solutions to manage these challenges and achieve positive results,” Wögerer continues.

Income summary

The balance sheet total amounted to CHF 2.5 billion as at the reporting date of 30 June 2024 and is very solid and liquid. Bank Frick has a very broad capital base. Net interest income of CHF 21 million is lower than the prior-year level, but is in line with expectations.

Client assets under management amounted to CHF 5.25 billion as at 30 June 2024 and grew by CHF 1.13 billion (+27.57%) compared to 31 December 2023 (CHF 4.1 billion).

Outlook for the second half of 2024

Wögerer is satisfied with the net profit of CHF 5.5 million. “This result confirms that our investments in the future were correct. Our goal remains to achieve the results of recent years again as we go forward. In this regard, the focus will remain on the company’s strategy in order to prepare us optimally for future developments, with our clients continuing to have top priority.” Despite the challenging macroeconomic environment, Bank Frick expects a net profit of just under CHF 12 million, says Wögerer.

About Bank Frick

Bank Frick specialises in banking for professional clients. The Liechtenstein bank provides a fully integrated offering of classic banking and blockchain banking services. Its clients include fintechs, asset managers, payment service providers, family offices, fund promoters, pension funds and fiduciaries.

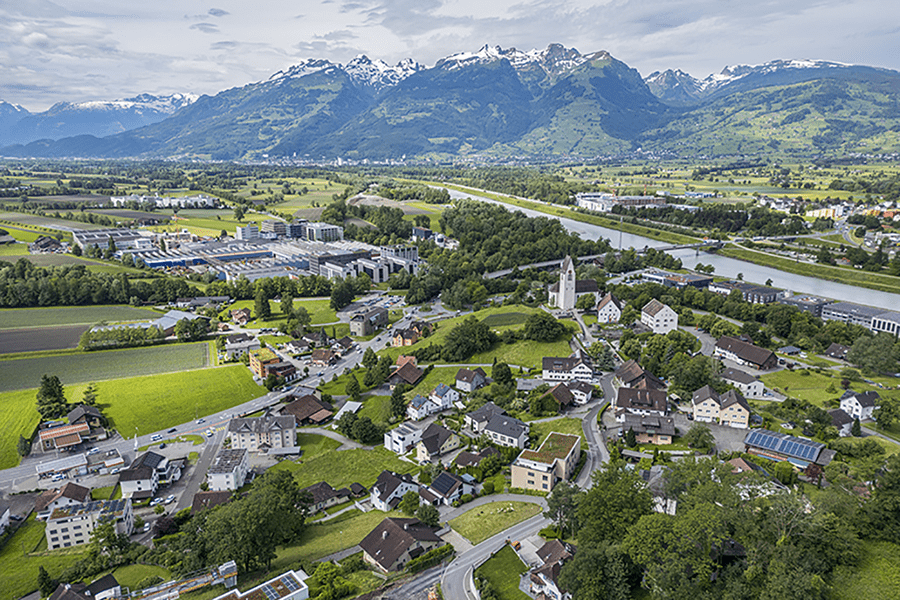

Bank Frick has been family-run since its foundation as a licensed universal bank in 1998, and it adopts an entrepreneurial approach. Today the Bank is entirely owned by the Kuno Frick Family Foundation (KFS). The Bank employs 260 members of staff at its Balzers office and operates a branch in London, UK.

Bank Frick is one of Europe’s pioneers of the regulated blockchain banking sector. The offering covers trading and custody of crypto assets and token sales. The Bank also develops tailored crypto-structuring solutions for intermediaries.

In addition to its highly regarded basic services, Bank Frick’s classic banking offerings cover services for funds and issues, focusing on formulating European (AIF, UCITS) and national fund solutions. In the capital market sector, Bank Frick develops tailored financial products for intermediaries and supports them along the whole issue process, acting also as a custodian bank.

Bank Frick is the only Liechtenstein bank with acquiring licences from Visa and MasterCard, and it can process card payments globally for payment service providers and their online merchants.